The Paytm Wallet is free and instant online money transfer app and it is one of the simple and securest way to do cashless transaction. Here are the five major changes in the latest Updated Paytm app for fast and secure cashless transactions, which are as follows:

- Finger Print Scanner – A New Security Feature

- “Add Money” feature is now Single-Screen

- Pay Anyone by Scanning Their Paytm QR Codes in Your Smartphone’s Image Gallery

- Self-Declared Paytm Merchants Can Now Accept up to 50,000

- Paytm Community Forums

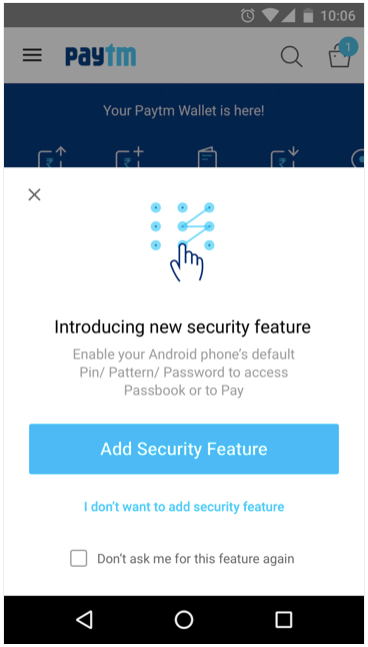

Finger Print Scanner – A New Security Feature

The Updated Paytm App has introduced new security feature through which if you lose or misplace your phone, your updated Paytm wallet will remains safe. The updated app has given option to Paytm users to select Phone’s Pin, App Password, Pattern or Fingerprint for secure transactions. Thus, if someone doesn’t know your personal PIN, Pattern or Password then they won’t be able to Send Money or see your Passbook.

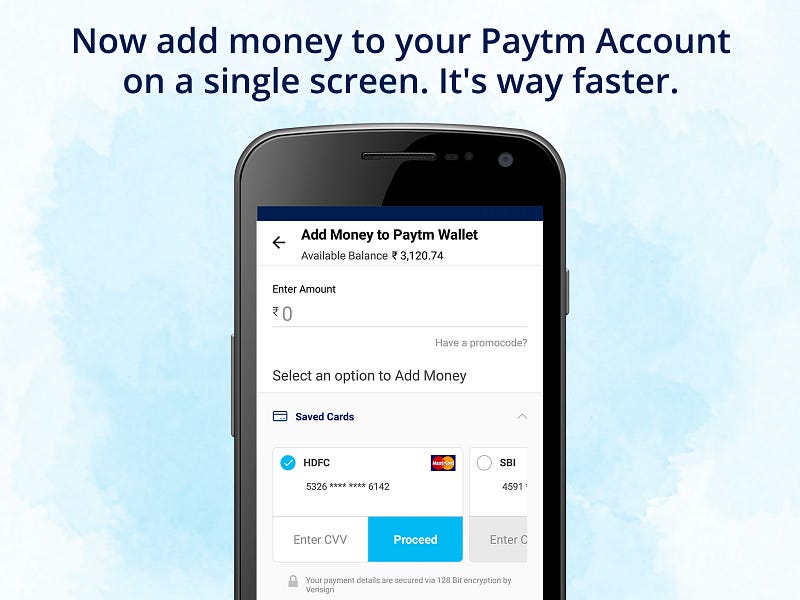

“Add Money” Feature is Now Single-Screen

Now, you can add money to your Paytm account on a single screen. In simple words, you can feed in the amount and choose payment option, both from the same screen.

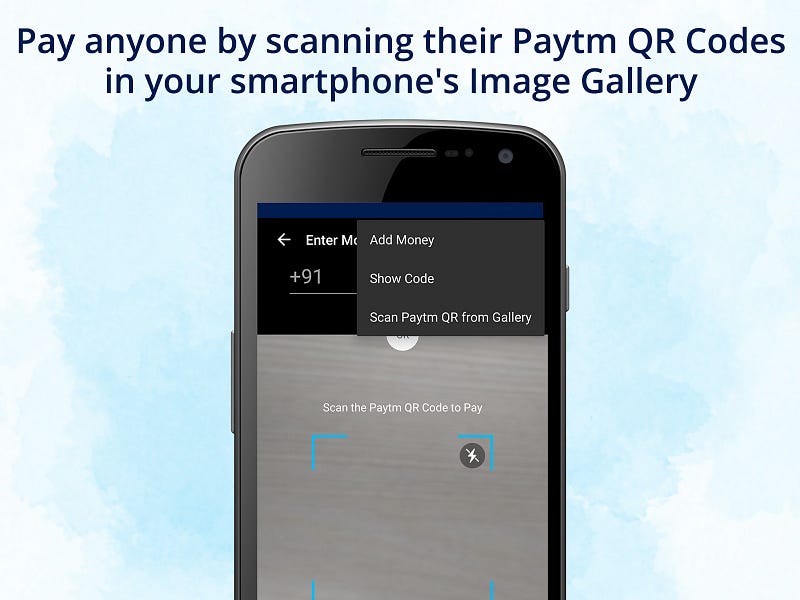

Pay Anyone by Scanning Their Paytm QR Codes in Your Smartphone’s Image Gallery

Now, you can pay anyone by scanning their Paytm QR Codes in your smartphone’s image gallery. For this, you have to ask your friend/relative to send you their Paytm QR codes through their e-mail or WhatsApp. Once you download that image in your phone gallery, you can directly scan your friend/relative’s QR code from your smartphone’s image gallery.

To do the above method on the Paytm app—

- Simply, tap on ‘Pay option’.

- When the QR scanner opens, on the upper-right corner you will notice the vertical ellipsis (more option) icon, tap on that and choose ‘Scan Paytm QR from Gallery’. Its’ that simple!

- Before making the payment, the confirmation message will come.

- Please check the details of yours and confirm it.

- Caution: If the recipient doesn’t have Paytm, the transaction will not be processed.

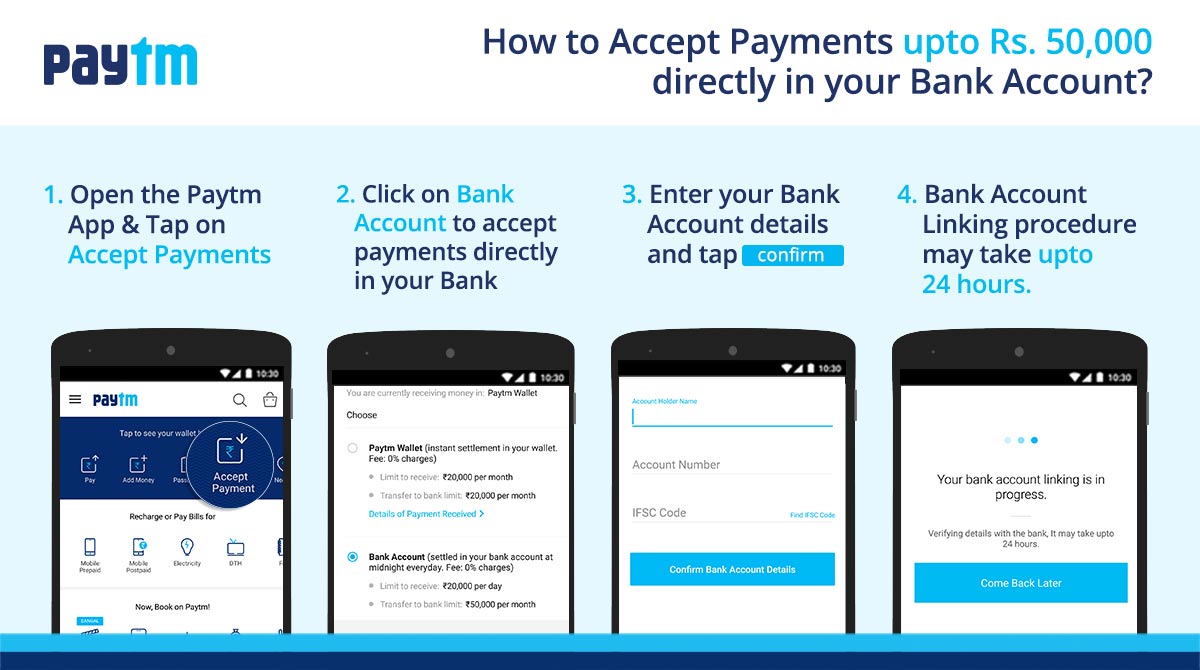

Self-Declared Paytm Merchants Can Now Accept up to 50,000

With an updated App, the self-declared Paytm merchants will now be able to accept (or transfer) up to 50,000 directly in their bank accounts. The day’s balance is sent to his/her bank account at midnight every day and there are no charges. The fee to transfer money to his/her bank account is 0% till 31st January 2017.

[Update]: The Paytm Wallet to Bank transfer fee will be 2% with effect from February 2, 2017 for Paytm users. Though, all self-declared Paytm merchants and shopkeepers will enjoy 0% charges while transferring money to their bank accounts.

How Paytm Merchants Can Self-Declare Themselves?

With this updated app, any and every merchant across India can now self-declare himself or herself as a merchant. In a bid to self-declare, Paytm merchants have to –

- Tap on ‘Accept Payment’ in the updated Paytm app.

- Select ‘Bank Account’ and enter bank details and confirm.

- Read the self-declaration & press –“I Confirm”.

- The Paytm app will typically takes 30 mins to an hour to connect to your bank account. The maximum time can go up to 24 hours.

- Caution: Wallet balance of a self-declared merchant should not exceed 20,000 post which the amount is settled directly to the merchant’s bank account.

Self-declared Paytm merchants can now accept up to 50,000 .

Paytm Community Forums

Paytm has also introduced the ‘Paytm Community Forums’ option within the app, so that users can get their queries addressed by other active users on the platform.