The Income Tax department has come out with a new e-facility for connecting the two unique identities of an individual that means to link Aadhaar & Permanent Account Number (PAN) in an easy manner.

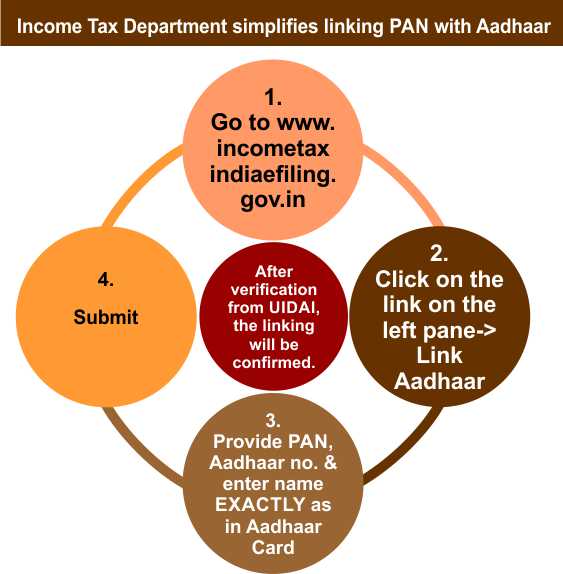

Simple steps to link Aadhaar with PAN

No need to login or be registered on Income Tax E-filing website.

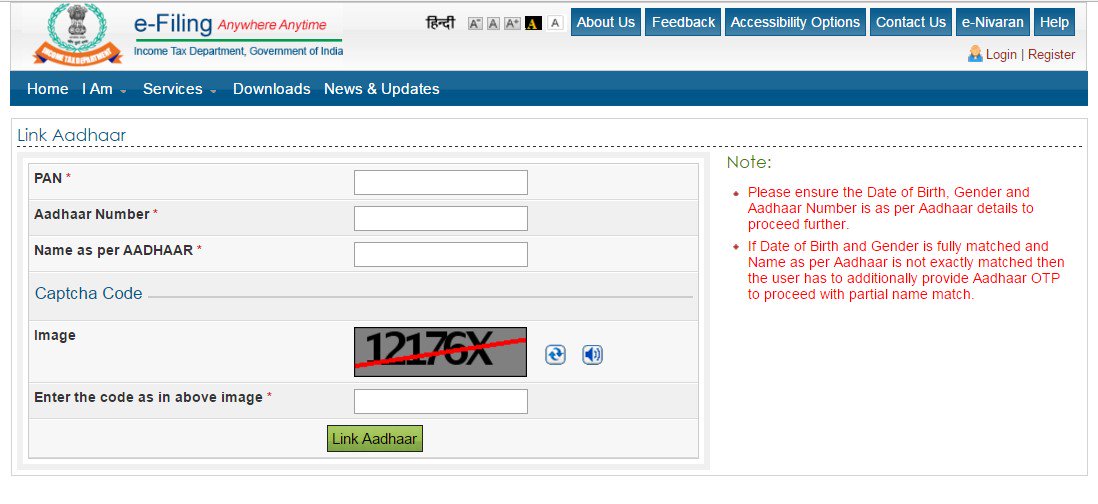

- Taxpayers can go to http://www.incometaxindiaefiling.gov.in/ and click on the link on the left panel Link Aadhaar.

- Provide PAN, Aadhaar no. and Enter name exactly as given in Aadhaar Card and submit.

- Taxpayers should ensure that the date of birth and gender in PAN and Aadhaar are exactly same.

- After verification from UIDAI, the linking will be confirmed. That’s it!

Minor mismatch in Aadhaar name: In case of any minor mismatch in Aadhaar name provided by taxpayer when compared to the actual data in Aadhaar, One Time Password (Aadhaar OTP) will be sent to the mobile registered with Aadhaar.

Rare Case: In a rare case where Aadhaar name is completely different from name in PAN, then the linking will fail and taxpayer will be prompted to change the name in either Aadhaar or in PAN database.

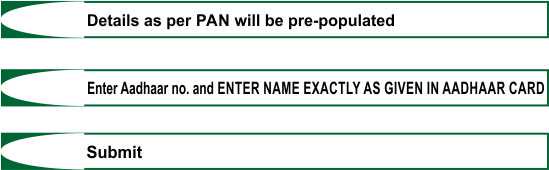

This facility is also available after login on the e-filing website under Profile settings and chooses Aadhaar linking. The details as per PAN will be pre-populated. Enter Aadhaar no. and enter name exactly as given in Aadhaar card (avoid spelling mistakes) and submit. That’s it!

Points to Remember

- This facility can be used by anyone to link their Aadhaar with PAN.

- This e-facility will be useful for E-Verification of Income Tax returns using OTP sent to their mobile registered with Aadhaar.

Under the Finance Act 2017, the Government of India (GoI) has made mandatory for taxpayers to quote Aadhaar or enrolment ID of the Aadhaar application form for filing Income Tax Returns (ITR).

Also, Aadhaar has been made mandatory for applying for PAN with effect from July 1, 2017.

Exemption From Aadhaar

Exemption for #Aadhaar to obtain #PAN cards and ITR tax returns will also apply on non-residents and non-citizens

https://t.co/uNmVSUMbE7 https://t.co/PoReud9t7F

— Techno Savie (@TechnoSavieNews) May 13, 2017

In a notification dated 11th May 2017, the Government of India has notified that the requirement of quoting of Aadhaar / Enrolment ID shall not apply to the four categories of individuals if they do not possess the Aadhaar / Enrolment ID:

- An individual who is residing in the state of Assam, Jammu and Kashmir and Meghalaya.

- An individual who is a non-resident as per the Income-tax Act, 1961.

- An individual of the age of eighty years or more at any time during the previous year.

- An individual who is not a citizen of India.

The announcement has been made by the government at a time when a case challenging mandatory use of Aadhaar for Permanent Account Number (PAN) and filing Income Tax Return (ITR) is pending in the Supreme Court. The apex court has reserved its verdict on a batch of pleas challenging the constitutional validity of a provision in the Income Tax Act to make Aadhaar mandatory.

READ MORE Supreme Court of India (SCI) ICMIS digital filing system: A move towards Digital Court

Note: PAN is a 10-digit alphanumeric number issued in the form of a laminated card by the IT department to any person, firm or entity, while Aadhaar is issued by the Unique Identification Authority of India (UIDAI) to a resident of India.

Income Tax Department simplifies linking of PAN with Aadhaar.https://t.co/qBiFrXg3Vj

— Income Tax India (@IncomeTaxIndia) May 11, 2017

READ MORE Bharat Ke Veer: A New Web Portal to Pay Homage and Support to Indian Soldiers Financially