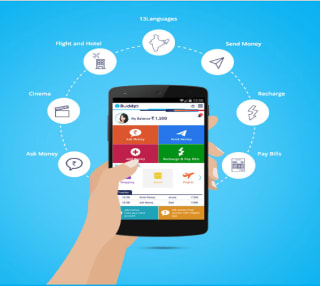

The State Bank of India (SBI) India’s largest lender bank, on August 2016 had launched a sbi mobile wallet app: State Bank Buddy. The app is available in 13 languages and in co-partnership with Accenture and MasterCard.

State Bank Buddy app is a semi-closed prepaid wallet that can be used to transfer money to other wallet users and bank accounts, anytime, anywhere.

First, users need to download this app and should have a valid mobile number and above the age of 10 years. You can register to the app, via Facebook or Sign up for the app via your mobile number, PIN or password or vaild email id.

The app was launched by Union Finance Minister Arun Jaitley and with Jayant Sinha, Minister of State for Civil Aviation and Hasmukh Adhia, Secretary, Department of Financial Services.

Arundhati Bhattacharya, chairperson, State Bank of India, said,

“This is one more step in our ambition of becoming the provider-of-choice for customers’ everyday needs, both financial and non-financial. Mobile is going to be at the centre of this transformation and this application will help us strengthen our proposition through this medium.”

Features of State Bank Buddy

- Languages: This app is available in 13 languages. There languages are Assamese, Bengali, English, Gujarati, Hindi, Kannada, Malayalam, Marathi, Oriya, Punjabi, Tamil, Telugu, and Urdu. User can select preferred language.

- Transfer Money: There is no need to stand in long queues. Transfer money in seconds. Simply, select a contact from phone book / Facebook, enter the amount and security pin for sending money anytime, anywhere and to anyone.

- Money: User can ask for owed money or simply ask for money when in need. ‘Buddy’ ensures that user can raise requests for money instantly and send reminders with just a click. User need to just select their contact and send an Ask Money request. State Bank Buddy will track it till user get own money back.

- Recharge: Just choose the Recharge and Bill Pay option on Buddy and user will get their topup instantly.

- Pay Bills: Just select Billing Details, pay the required Bill Amount and live hassle-free.

- Book Flight and Hotel: Users can book flights and hotels on their Buddy mobile app. Visit Shop and Earn section on State Bank Buddy, users can select the flight/ hotel of their choice and pay using their wallet balance and get a booking instantly.

- Book Movie Tickets: Book movie tickets with Buddy mobile app. Visit Shop and Earn section on State Bank Buddy, select the movie which user want to see, select seats, pay using wallet balance and users will get tickets to the favorite movie instantly.

- Transactions: Users can view their last 25 Buddy wallet transactions. Users can track all their pending payments.

- Security: If user lost phone he can block his wallet by calling on customer care center and can easily close & delete Buddy account. But, must sure there must be empty wallet balance.

KYC (Know Your Customer): Power up State Bank Buddy wallet with Internet Banking and user can unlock the following features:

| Limits per Wallet (on platform) | NIL KYC | Full KYC |

|---|---|---|

| Maximum balance at any point of time | 20,000/- | 50,000/- |

| Through Debit Cards | 5,000/- (Visa / MasterCard) 2,000 (RuPay) |

10,000/- |

| Total reload in a month | 20,000/- | 10,000/- |

| Top up through any channel per transaction | 20,000/- | 50,000/- |

| Total transactions (merchant transactions and fund transfers) – Daily limit – Monthly limit |

15,000/- 20,000/- |

50,000/- 1,00,000/- |

| Fund transfer (Transfer to Account) – Per transaction limit – Daily limit – Monthly limit |

2,000/- 2,000/- 20,000/- |

5,000/- 5,000/- 25,000/- |

| Cash out at ATM per transaction (Coming soon) | Not allowed | (under process)10,000/- |

Check latest Offers & Discounts on State Bank Buddy app. For more details, visit State Bank Buddy FAQ’s.

How Does State Bank Buddy Work

Users need to search State Bank Buddy on their smart phone. This app is available for both Android and iPhone users.

- Sign up: Users can use Facebook credentials or mobile number to sign up in this app. User must fill this details for sign up:

- Mobile Number

- Email ID

- 4 digit numeric PIN of choice

- One Time Password (OTP). User will receive OPT on their registered mobile number

- First Name & Last Name

- Date of Birth

- Security Question and Security Answer

- Must accept Terms and Condition

- Sign In: After providing all these information user can sign in. User will need to enter PIN every time to access the application.

- Add Money: Now user can add money to their wallet account using debit cards, net banking and IMPS credentials of their account with any bank.

This app can help you to save your time. Better to use State Bank Buddy instead of standing in long queue and waste your time.

Cashless Transaction

Recently, Airtel Payments Bank is one of the good example of digital revolution in India. The Airtel bank is fully digital and paperless bank and has become the India’s first payments bank to start operations and to offer basic banking services as a pilot basis in Rajasthan. Paytm is also another good example of cashless transaction, which is popular among people nowadays. The Paytm Wallet is free and one of the simple & securest way to do cashless transaction.